Uncategorized

Tips Invest 5 Million Cash How to proceed within the 2023’s Market

Articles

Borrowing Suisse suffered a keen exodus away from customer money you to produced it for the brink of collapse and lead to the original ever merger out of a few worldwide systemically extremely important banking companies. Clients who put their money at the Credit Suisse, now an excellent unit of UBS, earn up to 1.8percent to the fifty,one hundred thousand Swiss francs (54,000) or higher kept for three weeks, centered on among the anyone, who questioned to remain private as the amount try individual. While the Given hikes rates, experts have modified their traditional down 1 trillion from February, when dumps were estimated to rise because of the step 3percent inside the 2022. The newest twenty-four businesses that comprise the fresh KBW Nasdaq Lender Index and family 60percent of the country’s lender places try calculated observe dumps refuse 6percent within the 2022, depending on the Wall structure Street Log. For these strained which have mastercard bills, devising an organized month-to-month cost package is vital to slowly remove the fresh a good numbers.

Just after Fidelity ‘Glitch,’ Furious Customers Deal with Constraints to the Deposits | their site

Depositors from the Cayman Islands’ department of Silicone polymer Valley Bank found that out the hard method when their dumps had been grabbed by FDIC earlier this year following lender unsuccessful inside February. Dumps in the residential bank offices in the You.S. one to meet or exceed 250,100000 for every depositor/for each and every bank are perhaps not insured from the FDIC. Considering its regulating filings, at the time of December 30, 2022, JPMorgan Chase Lender N.A good.

MicroStrategy’s 5.4B Get Last week Adds to The Bitcoin Hoard; Stock Stumbles

- Instead, Pulley are a new adversary wearing market share and you may to make its very first appearance to the number.

- The organization told you it had financed the newest current bitcoin requests away from their product sales from convertible bonds and you will the new stock previously few days.

- In the an uncommon disperse, moreover it fined a few Citi executives, former CFO Gary Crittenden and you can trader-relationships chief Arthur Tildesley Jr.

- Private borrowing investment is finance and other debt funding so you can subscribers who’re doing enterprises, investing home, or you need funding to expand team procedures.

- Considering 2025, in case your Fed features cost where he’s or reduces him or her far more, Video game cost you may stay apartment or refuse somewhat.

This means that the fresh mega banking institutions would be the franchisor and’ve shifted its fake financial inspections and fake fret testing in order to the fresh Given, to own appearances benefit. Of your 20 chairmen who preceded me personally during the FDIC, nine encountered a majority of the brand new panel players in the opposite group, in addition to Mr. Gruenberg as the chairman lower than President Trump up until We replaced your because the president within the 2018. Never before provides most the newest panel tried to prevent the fresh chairman to pursue her schedule. And you can my personal home is obviously open to those individuals happy to participate in a fashion that befits the new venerated establishment we are privileged to serve.

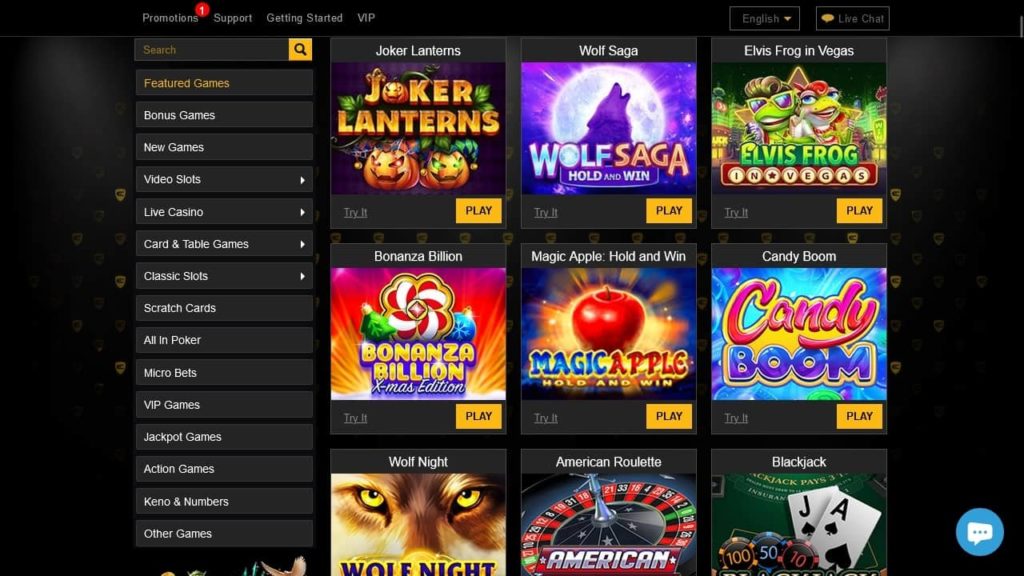

Overall, WSM casino indeed ranking one of the better Bitcoin and you can crypto gambling enterprises on the market today in the business. The major options are determined from the popularity, ratings and you can regularity away from hunt. This is the answer for the new crossword clue Lender put (web based poker legend Ungar) seemed inside the Wall structure Road Diary puzzle for the December 19, 2024. Among them, you to provider stands out with a great percent suits which includes a period of six characters. Dennis Shirshikov, lead of progress from the Awning, underscores the significance of enhancing so it crisis money.

The bank must also try to hold subscribers who does have experienced financing in both banking companies and may now check out give the risk. In case your suggestion survives as the organized, that’s gonna mean an extremely highest financial struck in order to JPMorgan Chase or any other super banking their site companies that have huge amounts from uninsured places. There will be something else outstanding about that uncharacteristic spurt from kindness from JPMorgan Pursue. By obtaining a minimum of 5 million within the the brand new external currency to obtain the six percent Video game, the financial institution seems to be effectively soliciting to grow its already eyebrow-raising quantity of uninsured places.

So it essay provides historic reviews to help clarify just how this type of issues may have increased the severity of current runs prior to other significant runs one to happened back in 1984 and you will 2008—the most really serious works inside You.S. history because the High Depression and you may up until now. Inside a statement, Basic Republic inventor Jim Herbert and you may President Mike Roffler said the new “cumulative assistance strengthens our very own liquidity reputation (…) which can be a vote from trust to possess First Republic as well as the whole United states bank system.” The brand new disperse scratches a dramatic step by the loan providers to bolster the computer and simplicity issues out of regional bank disappointments. The newest chairman, to the agree of one’s Senate, in addition to designates one of many designated participants because the president of your own panel, so you can serve a five-season label and another of your own appointed professionals since the vice chairman of one’s panel. The 2 ex officio players is the Comptroller of the Money plus the director of the User Economic Defense Agency (CFPB). Whenever a bank gets undercapitalized, the fresh institution’s primary regulator issues an alert to the financial.

After St. Denis accomplished a meeting phone call for the government, Cassano all of a sudden bust for the area and began yelling during the your to own conversing with the newest York place of work. He then launched you to St. Denis was “on purpose omitted” out of one valuations of the most dangerous components of the fresh types portfolio — for this reason preventing the accountant of doing his jobs. Just what St. Denis illustrated try openness — as well as the final thing Cassano required try transparency. In the example of Lehman Brothers, the fresh SEC got a spin half a year through to the crash to help you flow against Cock Fuld, a man has just called the fresh poor Chief executive officer of all time by the Profile journal. Ten years before the freeze, a good Lehman lawyer named Oliver Budde is going through the financial’s proxy comments and you may noticed that it actually was having fun with an excellent loophole connected with Limited Inventory Products to cover up tens of huge amount of money away from Fuld’s payment. Budde advised their bosses one Lehman’s usage of RSUs try dicey at best, nonetheless they blew him from.

Federally chartered thrifts are actually controlled by the Workplace of the Comptroller of one’s Money (OCC), and state-chartered thrifts from the FDIC. Silicon Valley Bank and you will Signature Bank depicted next and you may 3rd biggest financial problems, correspondingly, inside the U.S. records. (The greatest is actually Arizona Common, and that failed inside 2008 economic crisis.) However in regards to the size of its deposits, we’re speaking of minnows than the deposit visibility from the the newest whale banks to your Wall surface Highway. As the huge amounts of dollars in the domestic uninsured dumps have been at stake at the both unsuccessful banks, federal bodies awarded an excellent “unique chance research” one welcome the newest FDIC to fund all uninsured domestic deposits. One action lead to huge amounts of bucks within the extra loss to the brand new FDIC’s Put Insurance Money (DIF).

That would be an enormous shed on the 2023 average out of twenty-six, but the plan nonetheless faces court and you can prospective governmental challenges. Please happen around while we address it and you will restore their customized listings. A potential Trump administration’s specialist-company stance, reducing control and you may a great interest rate background. Right now, output is impressive both for short and you may a lot of time-identity Dvds — a favourite cities to locate him or her are CIT Financial.

Berkshire has been unloading financial offers, and that of JPMorgan Chase and Wells Fargo, as the in the beginning of the 2020 pandemic. The guy stays able, together with business’s solid cash pile, to act once again if the condition requires they, Buffett told you throughout the his annual investors’ meeting. This blog offers commentary, research and you may investigation from your economists and you may professionals. Feedback shown aren’t always the ones from the newest St. Louis Given otherwise Government Put aside Program. “The new incentives out of high advanced creditors to operate for the an excellent as well large to fail lender.” Journal out of Financial Balances, 2019.

Money market fund swell up by more than 286bn in the course of put airline

Recently, he inserted 5 billion to the Goldman Sachs in the 2008 and something 5 billion inside Financial away from The united states in 2011, enabling balance all of the individuals companies. The fresh Financial Work from 1935 produced the newest FDIC a long-term department of one’s government and given permanent put insurance coverage maintained from the 5,100 height. The numbers one a certain depositor has inside accounts in any form of control classification at the a certain bank are added along with her and are covered up to 250,100. Apple is perhaps the largest enigma on the AI land certainly one of the major technical enterprises. The business has been slow in order to diving on the AI arena, and it’s too soon to share with in the event the its method around Fruit Cleverness (the fresh sales nickname to possess Apple’s AI products) pays out of. However the real fireworks came whenever Khuzami, the brand new SEC’s director of administration, talked about an alternative “collaboration initiative” the fresh department got recently expose, in which professionals are now being considering incentives to help you declaration con it have witnessed otherwise enough time.

Hence, which settlement get impression how, where and in what order items are available inside checklist categories, except in which banned for legal reasons in regards to our financial, house security and other home lending options. Additional factors, such our very own proprietary webpages laws and you can if or not a product or service exists close by or at your thinking-selected credit history diversity, also can effect just how and you may in which items show up on the site. As we try and render a wide range of now offers, Bankrate doesn’t come with details about all of the economic otherwise credit equipment otherwise provider.

The greatest deviation from historic comparisons is that depositors in the financial institutions you to knowledgeable operates recently have been strangely related to otherwise comparable together. In the Silicone polymer Valley Bank, depositors had been connected as a result of common capital raising backers and matched up the withdrawals due to smartphone communication and you can social media. From the Signature Bank and you can Silvergate Bank, higher servings away from depositors have been crypto-resource businesses that used the a couple banks the real deal-date money collectively, business patterns based on moving money quickly. These types of crypto-resource community depositors will also have been such as sensitive to counterparty chance considering the volatility inside crypto-advantage locations along side previous seasons. This should not the 1st time you to definitely Citigroup’s Citibank provides lay a tool to the taxpayers’ direct to the reckless ways it will company.